Diversified Property Funds

What is a property fund?

A property fund, also commonly known as a property syndicate or property trust, is a professionally managed fund providing the opportunity for investors to invest in – or hold part ownership of – property which may not be available to them as individuals.

Investors buy units in the fund, such as CPDF, which owns one or many properties, and it is managed by a professional fund manager, such as Clarence Property. The fund manager collects the rent and manages maintenance and administration of the properties, then pays a regular distribution (typically monthly or quarterly) of the net income to investors.

What is a diversified property fund?

A diversified property fund is an investment option offering exposure to a diverse mix of property assets across a range of property sectors and geographic locations. Diversification is a portfolio risk management strategy which aims to limit exposure to any single asset or risk. Diversification of investment assets can assist in mitigating the effects of an unusual event in one property sector or location, on an entire portfolio.

When applied as an investment strategy to a property fund, diversification is implemented through investments in varying asset types such as retail, commercial, industrial, medical, childcare, rural and development. Geographic spread can also be used to further diversify a portfolio.

Why invest in a diversified property fund?

- Diversified property funds commonly offer stable income distributions to investors on a regular basis.

- A portfolio of assets across diversified asset classes can help manage investment risk during market fluctuations.

- A diversified portfolio of properties may reduce volatility in income generation.

- Investment in a property fund removes the hassle of managing or leasing a property directly.

- Although capital growth is not guaranteed, it may occur through general market appreciation, and may also be driven by effective management of a property portfolio.

How to invest in a diversified property fund

When you invest directly in a diversified fund, you buy units or shares in the fund, which is managed by a fund manager.

Clarence Property is a specialist fund manager, providing investors access to an income-generating property fund which owns properties in a variety of sectors ranging from industrial and commercial, to healthcare and rural, from established properties to new developments.

Click here to read more about Clarence Property’s flagship property fund, Clarence Property Diversified Fund (CPDF).

Investing in a property fund has many benefits, including:

Diversification: By investing in a property trust, you can either spread your risk across multiple properties or through a single property (known as a syndicate).

Shared risk: Because you are not the only investor/owner in a property trust, any investment outcomes will be diluted across multiple investors.

Professional management: Property trusts are usually managed by professional property managers who have the expertise and experience to maximise the return on investment.

Competitive income: Property trusts typically offer competitive income returns, which can provide a steadier stream of passive income.

Capital growth potential: If the property market experiences capital growth, your investment in a property trust is likely to increase in value.

The opportunity to own property: By investing in a property trust, you can own property without having to deal with the day-to-day hassle of being a landlord.

Tax benefits: you may benefit from the receipt of tax-free,tax-deferred income or the receipt of franking credits as a distribution of your units held in a property trust.

Ready to invest in the Clarence Property Diversified Fund?

Get the Latest News

Clarence Property purchases 120 Edward Street!

Clarence Property is going to AgQuip 2023

Now Selling: Final Beachfront lots at Casuarina, NSW

EnviroDevelopment Certification

Clarence Property goes to FarmFest 2023!

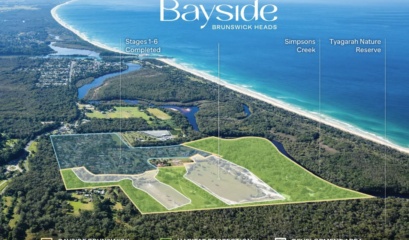

Development Approval – Bayside, Brunswick Heads

Clarence Property at Primex 2023

Clarence Property Corporation Limited ACN 094 710 942, AFSL 230212, is the issuer of the PDS for Clarence Property Diversified Fund ARSN 095 611 804 and Epiq Lennox Property Trust ARSN 626 201 974. Please read the PDS and TMD at clarenceproperty.com.au before deciding whether to invest.

This website is not intended to be and does not constitute a PDS or any form of disclosure document, as defined by the Corporations Act 2001 (Cth). This website does not constitute an offer for the sale or purchase of units, and does not constitute any recommendation in relation to investing. This website has been prepared without taking into account any particular consumers financial situation, objectives or needs.

Whilst every care has been taken by Clarence Property in the preparation of this website, Clarence Property does not make any representation or warranty as to the accuracy or completeness of any statement in it. Persons viewing this website should conduct their own inquiries and investigations. The information on this website is subject to change, and Clarence Property is not responsible for providing updated information to any person.

Subject to any responsibilities implied by law and which cannot be excluded, Clarence Property is not liable to you for any losses, damages, liabilities, claims and expenses (including but not limited to legal costs and defence or settlement costs) whatsoever arising out of or referable to any material on this website or any third party website whether in contract, tort including negligence, statute or otherwise.

In the spirit of reconciliation Clarence Property acknowledges the Traditional Custodians of country throughout Australia and their connections to land, sea and community. We pay our respect to their Elders past, present and emerging and extend that respect to all Aboriginal and Torres Strait Islander peoples today.